How the Climate Crisis and

Environmental Justice Act Works

Protects the public health, economic well-being, and natural treasures of the State

by supporting the new statewide, greenhouse gas emission reduction goals set by the Climate Solutions Now Act of 2022:

Zero

emissions after 2045 using 2006 emission levels as a baseline

Establishes two types of fossil fuel fees that include a polluter pays, no-pass through provision:

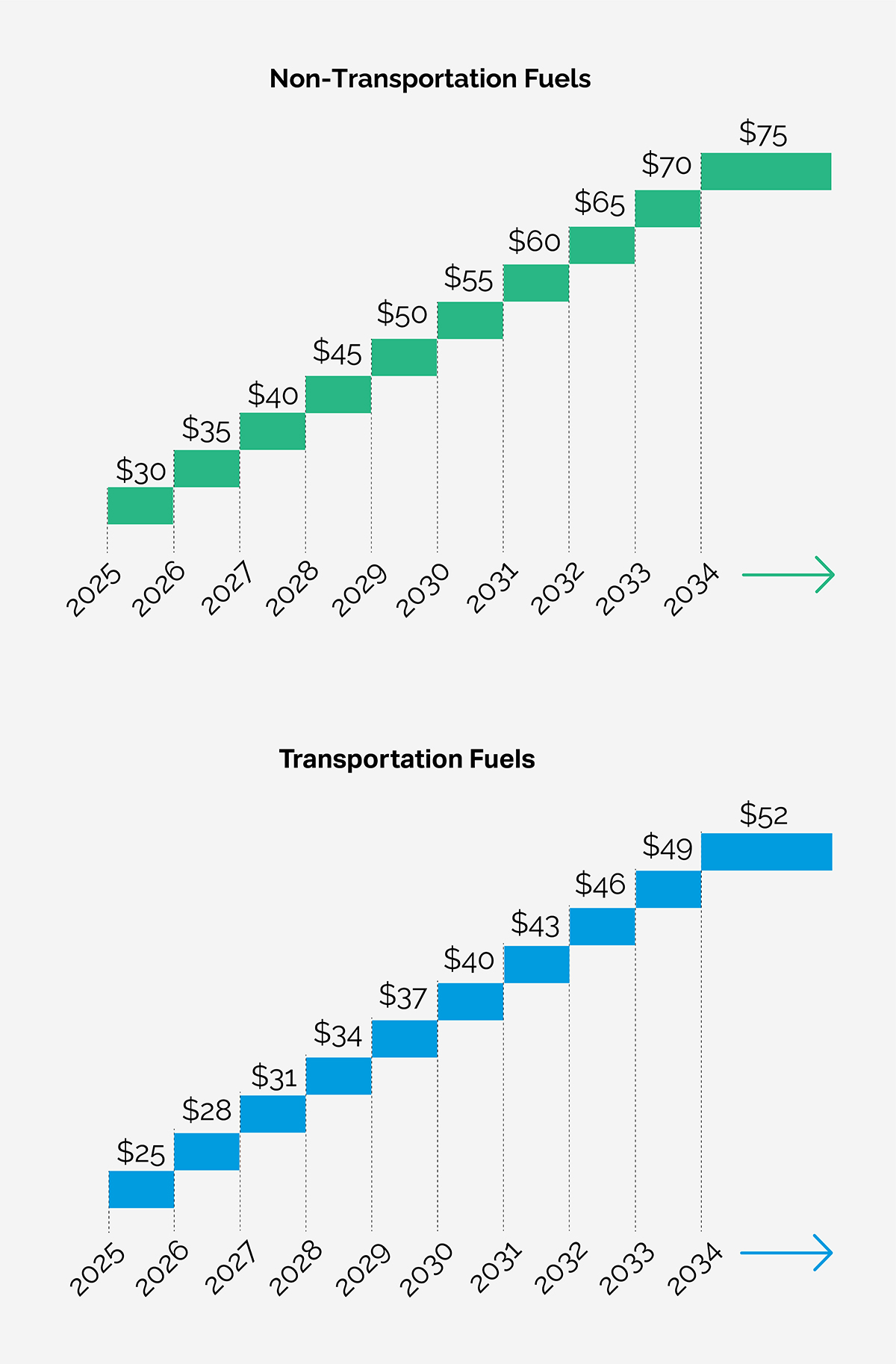

Non-transportation fuel fee (Building Heat) starts at $30/ton CO2, increases $5/ton per year, and is capped at $75/ton until the target is met.

Transportation fuel fee (Gas) starts at $25/ton CO2, increases $3/ton per year, and is capped at $52/ton until the target is met.

Establishes revenue for two separate funds

for green infrastructure, and household and employer benefits:

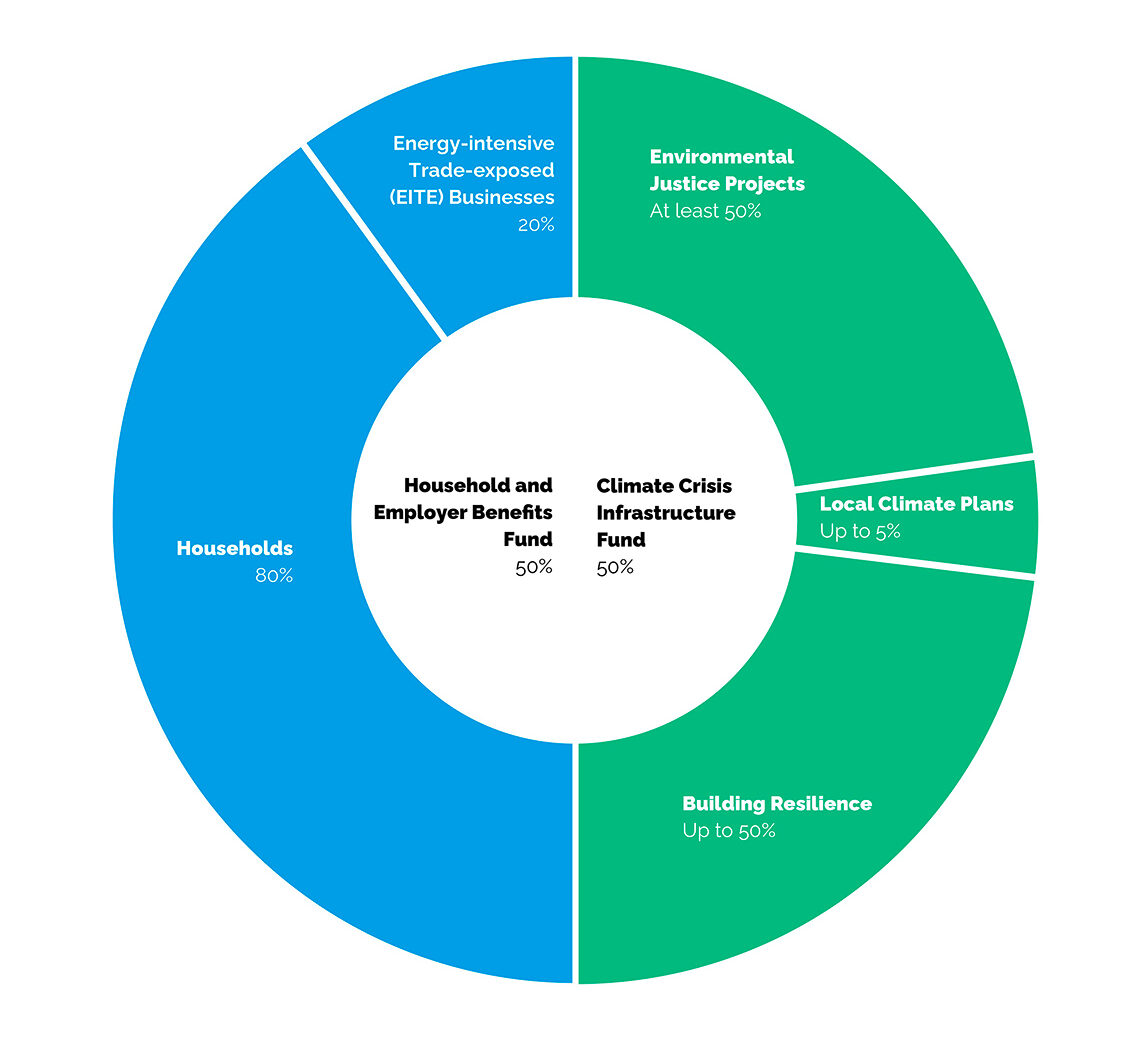

Benefits Fund: 50% of the total revenue will go to low- and moderate-income households and energy-intensive trade-exposed (EITE) businesses to protect them from financial harm

80% of the money in the Benefit Fund directed to low- and moderate-income household Benefits

20% of the money in the Benefit Fund directed to EITE business Benefits

Infrastructure Fund: 50% of the total revenue will go to the Climate Crisis Infrastructure Fund – to invest in initiatives that improve the health and welfare of the citizens of the State

At least 50% of the Infrastructure Fund shall be invested in projects that are directly located within and provide meaningful benefits to environmental justice communities

Up to 5% of the infrastructure account shall provide technical assistance, capacity, and planning tools to county and municipal governments to develop qualified local climate plans and investment proposals

Up to 50% of the Infrastructure account shall be disbursed to qualified county and municipal governments for projects to mitigate GHG’s and build resilience